Last Updated on February 5, 2024 by Henry @ The Getaway Lounge

This post is reviewed on a regular basis to ensure a high level of accuracy.

Well, it’s my favourite travel card hands down, and it’s the only one I’ve been willing to write a great review on so far.

I’ve had my fair share of experiences with various travel cards like Revolut, which was a good solution, but none of them have left me as impressed as Currensea.

It’s the UK’s first direct debit travel card, designed to simplify and streamline international spending, and here’s why I highly recommend it.

Ready to give it a try? Open a free account here

Currensea’s standout feature for me is its seamless and secure integration with your existing bank account, all possible through open banking technology.

This sets it apart from many other travel cards and foreign currency exchange services.

You don’t need to open a new bank account – Currensea works in harmony with all major UK banks, making it easily accessible to a wide range of users.

One of the annoyances of using traditional travel cards is the need to pre-load them with the desired currency.

I don’t know about anyone else, but I would often forget to top mine up, and so I would just end up using my usual bank card which obviously defeats the object!

Currensea eliminates this inconvenience completely.

As long as there is money in your bank account, you’re good to go, and there’s no need to do any exchanges from pounds to Euro’s say.

You can use it with the same ease as your regular bank card, reducing the likelihood of being caught out without access to your funds when you need them most.

With Currensea, you simply use it like your normal bank card and it will automatically convert your pounds into the local currency, at a fantastic rate.

To remind you of your savings against the traditional banks, you’ll get a handy notification after every transaction, knowing that the money will be collected directly from your existing bank account by direct debit, which is a a refreshing and convenient approach to international spending.

So, the all important question is how much does it cost for a transaction, or to withdraw cash in the local currency?

Well they have several plans to consider.

If you opt for the free plan, you’ll face a small 0.5% Foreign Exchange fee on every transaction, which still means you’ll save around 85% compared to your banks charges.

We opted for the Premium plan however for just £25 per year, reducing the FX to 0%, which saves 100% of bank charges!

Premium is worthwhile it if you intend on using it more than just a couple of times each year.

In regards to cash, you can withdraw up to £500 per month on both plans completely fee free (although some ATM’s will charge their own fee).

If you go over the £500 per month you’ll be subject to FX fees, so you should try and stay within this limit if possible.

Besides, not many place don’t take card these days so we’d recommend paying by this method where possible.

After each transaction, you receive a detailed breakdown of what you’ve spent and where.

This level of transparency ensures that you’re always aware of your financial activities and can manage your budget effectively while abroad.

Additionally, Currensea provides insights into the average savings compared to traditional high street banks, helping you understand the value you’re getting from this innovative travel card.

You’ll even get an email after you arrive home with a breakdown of your estimated savings throughout the whole trip.

I’ve been on several short breaks in Europe using Currensea so far, and the savings have far outweighed the cost of the Premium plan which I opted for.

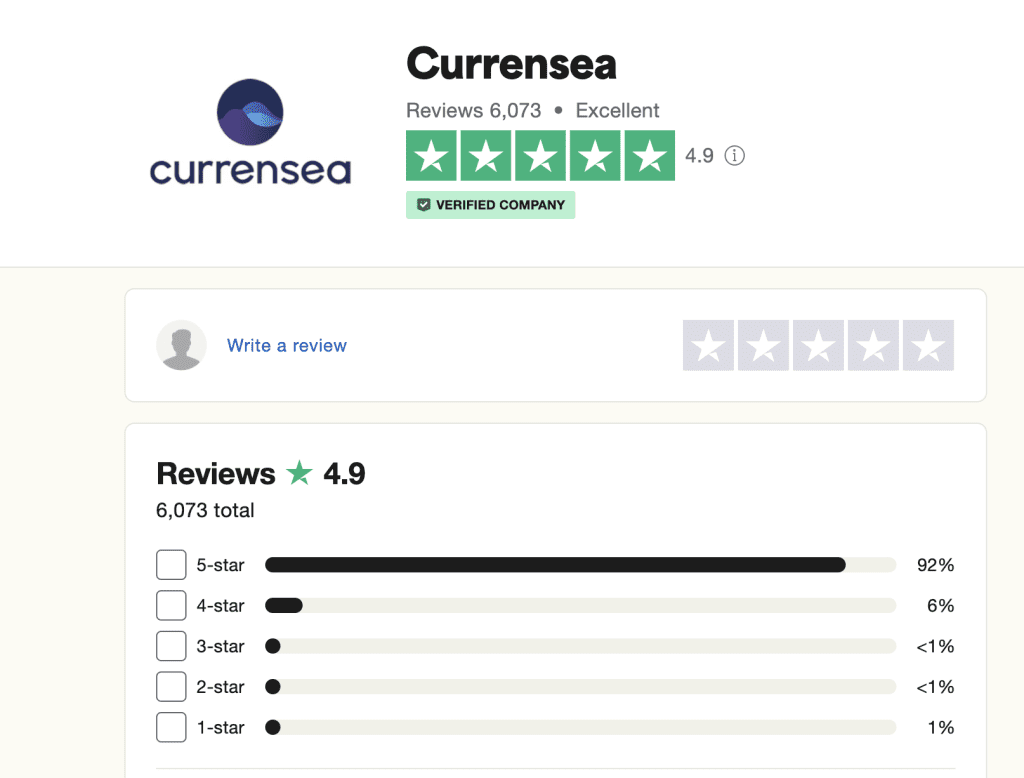

Their reviews on Trustpilot reflect the real-world experiences of travellers who have embraced Currensea and experienced its benefits firsthand.

I’m not surprised in the slightest to see such great reviews!

In my years of trying many different travel cards, Currensea has truly impressed me and thousands of others.

Its seamless integration with your existing bank account, elimination of the pre-loading hassle, and the ability to spend abroad without transaction fees make it a game-changer in the world of travel cards.

And whether you’re taking out the free plan or the Premium plan to enjoy fee-free spending, Currensea is well worth it especially for frequent travellers.

And with an almost perfect ratings on Trustpilot and handy transaction notifications, Currensea not only simplifies international spending but also empowers you with insights into your travel finances.

So if you want convenience, cost-effectiveness, and peace of mind while abroad, Currensea is a fantastic choice.

Give the free plan a try, and I’m confident you’ll be impressed enough to upgrade to Premium.

Oh, and there is also the option to upgrade to their Elite plan which comes with a host of other goodies, for example discounted Airport Lounge Passes and more!

Ready to give it a try? Open a free account here

Leave a Reply